Report to/Rapport

au:

Health, Recreation

and Social Services Committee

Comité de la santé, des loisirs et des services

sociaux

and Council/et au Conseil

12 November 2002/le 12 novembre 2002

Submitted by/Soumis par: Jocelyne St Jean, General Manager/Directrice générale

People Services

Department/Services aux citoyens

Contact/Personne-ressource: Colleen Hendrick, Director/

Innovation,

Development and Partnerships

Directrice, Innovation, développement et

partenariat

724-4122 ext. 24366, colleen.hendrick@ottawa.ca

|

|

|

Ref

N°: ACS2002-PEO-IDP-0031

|

SUBJECT: OTTAWA COMMUNITY LOAN FUND

OBJET: FONDS

DE PRÊTS COMMUNAUTAIRES D’OTTAWA

REPORT RECOMMENDATION

That the Health, Recreation and Social Services Committee

recommend Council approve the previous policy and practice

of the former Region of Ottawa-Carleton for designated donations to the Ottawa

Community Loan Fund (OCLF)

RECOMMANDATION

DU RAPPORT

Que le Comité de la santé, des loisirs et des

services sociaux recommande au Conseil d’adopter la politique et la pratique

de l’ancienne Région pour ce qui concerne les dons désignés au Fonds de prêts

communautaires d’Ottawa.

BACKGROUND

The Ottawa Community Loan Fund (OCLF) was formed in 2000 as

a non-profit corporation to provide Ottawa with a community-financing vehicle.

The OCLF provides loans to entrepreneurs, groups and individuals who wish to

achieve a greater level of self-sufficiency through self-employment or business

expansion.

As a community lender, the OCLF enlists donations and loans

from the local community, government and other non-profit organizations to

create a pool of funds. Loan capital is then lent out to promising individuals

or groups of people who are starting or expanding a business in the Ottawa

area.

OCLF works with people who have a solid business idea,

supported by a business plan but who are having difficulty obtaining financing

through traditional funding sources. Unlike larger financial institutions that

rely primarily on an applicant’s credit history and assets, OCLF uses criteria

that place a greater emphasis on an individual’s character, (how

is it assessed?),commitment

and ability.

OCLF provides loans up to $15,000 to groups and individuals

who have a solid business plan, practical work experience and/or training. In

addition, individuals and groups must demonstrate a commitment and ability to

develop or expand a business and must have the capacity to repay their loan so

that other borrowers can access OCLF financing. OCLF also works with the

Canadian Youth Business Foundation to provide loans to entrepreneurs ages

18-34.

By providing access to small amounts of capital, the OCLF

has a direct impact on new business creation, local employment and

investment.

DISCUSSION

Several community

reports have identified gaps related to accessing capital to promote

micro-entrepreneurs. These include the Mayor’s Task Force on Employment, the

Task Force on Poverty and various reports from the Ottawa Economic Development

Corporation. The studies identified the need to provide more support to

individuals who want to pursue self-employment and business expansion

opportunities. Access to financing was acknowledged as a barrier to pursuing

self- employment among low-income individuals and families.

OCLF funds are accessible

by people who are unemployed or under employed, including new Canadians, youth

and people receiving Ontario Works or Employment Insurance. Cooperatives and

non-profit organizations are also eligible to apply to the OCLF.

In 2001, the People Services Department entered into a

purchase of service agreement with the OCLF. This purchase of service agreement

provides $ 40,000 annually towards the operations of the program for three

years to assist people to become self-sufficient through self-employment.

In order to qualify as a registered charity as part of the

Community Economic Development Programs within the Canada Customs and Revenue

Agency, the OCLF would have to comply with very strict guidelines relating to

its policies for borrower selection, interest rates, loan repayments, loan

renewals, loan amount and structure etc. Compliance with these federal

requirements would limit the capacity of the OCLF from fulfilling its mandate

and by forcing it to adopt policies that may not be consistent with the purposes

of the OCLF.

As a result, two years ago the OCLF requested that the City

receive donations and issue tax receipts. To date, the City has processed seven

donations totaling $80,000.The OCLF will be embarking on a major fundraising

campaign in February 2003 with a goal of raising approximately $750,000 over a

three year period to meet increased loan demand.

The People Services Department strongly supports the OCLF

because this organization provides access to financing that many low-income

individuals and groups would not otherwise be able to obtain in order to launch

self-employment business opportunities. OCLF has assisted 14 low-income

individuals and groups to launch self-employment opportunities and to become

self-sufficient during the past two years.

In addition, the OCLF has provided financing to three individuals of

low-income to assist them in covering tuition costs and living expenses while

they become accredited through the Foreign Trained Teacher Initiative.

In total, the OCLF has disbursed 21 loans totaling $159,000

resulting in the creation or expansion of 16 businesses and three soon-to-be

accredited teachers. As the OCLF

approaches its second anniversary of lending, it has a default rate of 0%.

RURAL IMPLICATIONS

Individuals and groups in the

rural communities can also apply to this program for funds.

CONSULTATION

Not applicable.

FINANCIAL IMPLICATIONS

Donations are received from

donors to the Ottawa Community Loan Fund (OCLF); the City deposits the amounts

and a donation receipt provided to the donor. The City issues a cheque to the

OCLF for the amount designated by the donor.

There is no cost to the City as current resources are sufficient to

accommodate this process.

ATTACHMENTS

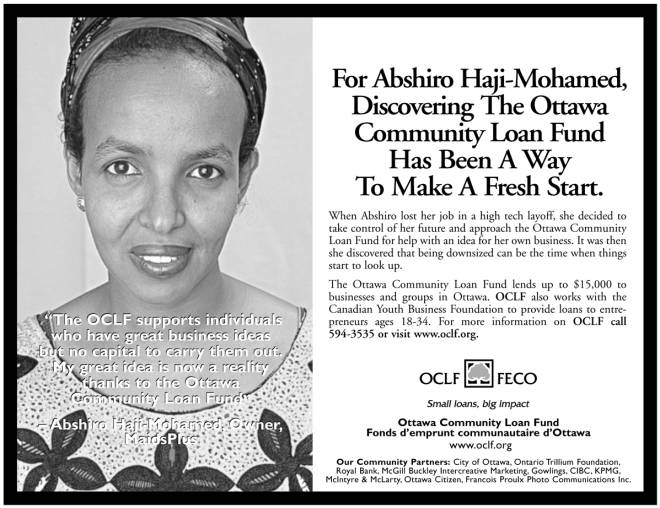

Annex 1 presents information on the OCLF service from a

user perspective.

Annex 2 presents a list of the

OCLF board of directors.

DISPOSITION